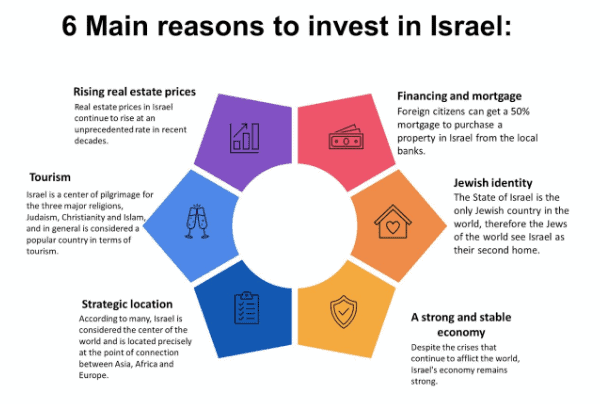

Despite its small size, the State of Israel is one of the most talked about countries in the world media. It’s partly because of the country’s political conflicts that have lasted thousands of years and because it is the center and pilgrimage destination for the world’s three major religions, among others.

But there is something else special about Israel that the international media misses: it is one of the best real estate investment destinations in the world. In 2022 the price of real estate in Israel went up by almost 20%!

Almost 92% of Israel’s land is owned by the state (RMI), creating a “monopoly” and effectively eliminating the behavior and effects of a free market. The state decides how many apartments to thaw and for what purpose (residential, commercial, agricultural, public areas, offices, etc.).

This directly affects the supply and demand because if there are fewer lands available as a result of the RMI decisions, the price of the lands will directly increase.

The vast majority of new real estate in Israeli projects are built only with traditional/conventional construction methods. Meanwhile, in the western world and the developed east (China and Japan), large projects are built using modern construction methods such as “modular construction” (manufacturing main parts in a factory and assembling them at the construction site). This modern method can reduce construction costs in Israel by 40%-60%. This is very significant, especially when it comes to large projects with towers or new neighborhoods.

The Israeli market is not ready for this due to ideology. For comparison, construction costs today for a developer/contractor range from 4,500 to 7,700 NIS per square meter (at the completion level = getting a key). With modern construction methods prices can range from 2,500 to 3,500 NIS per square meter.

Today Chinese and American companies are trying to implement these methods in the construction system in Israel. We will probably see a change in the coming years, but not yet.e.

Beyond the price differences in construction methods, the modern methods are also faster, taking just about half the time to complete..

One of the main factors that influences the increase in real estate prices is the pace that new construction starts. Just like in basic trade, when there is a lack of a product, product prices rise. According to the CBS (Central Bureau of Statistics) data, in the 12 months between April 2017 and April 2018, construction of 43,350 new apartments in Israel began. Maybe that sounds like a lot of apartments, but it’s actually a 22% decrease compared to the previous year. In order to reduce the demand gap, approximately 70,000 new apartments must be built every year, thus increasing supply and balancing apartment prices.

One of the reasons there aren’t many new construction projects is the long and complicated licensing and bureaucracy procedures to obtain planning approvals and building permits.

It is worth noting that the “Resident Price” program should help to reduce the gap in the long run, but it is still too early to determine this. This is not the place to go into the details of the price plan for residents, but people from the real estate industry in Israel criticize this plan, claiming that it does not prove itself despite the low “target prices.” If the topic interests you, you can read a lot about it online.

When interest rates in the economy are low, financing costs become cheaper, which causes more people to look for investment opportunities because money and financing “are cheap.” When interest rates in the economy are low, more people can afford to commit to a mortgage and purchase investment properties.

All these factors affect the real estate market in Israel and almost all of them are derivatives of demand and supply.

It doesn’t matter if someone wants to purchase a property for investment purposes or as a future residence in the only Jewish state. Investors from all over the world understand the uniqueness of Israel in that it is a small country with significantly limited supply in relation to demand. Investors from all over the world want to invest in Israel, a fact that dramatically increases the demand that turns the real estate market in Israel into a stable investment channel with huge profit potential!

When we look at the reasons that lead to the rising real estate prices in Israeli and understand that there are many reasons that the state does not succeed and perhaps does not even try to take control of and improve them, I conclude that in terms of investment potential there is a very high return on apartment purchases in Israel. In addition and perhaps more importantly, there is great stability and very low risk. So yes, the answer is that buying an apartment in Israel is an excellent investment.

Average increase in apartment prices by year | Year |

4.3% | 2019 |

4.2% | 2020 |

13.1% | 2021 |

19.8% | 2022 |

A mortgage is the most convenient form of financing because the bank has a low risk (assuming repayments are not met, the bank takes the property and sells it through a receiver – the surplus from the sale after covering the loan debt will return to the owner). The duration is usually for a long period, so the bank can give relatively good conditions including interest (depending on the market situation). For all matters of mortgages, the banks work according to the instructions of the Bank of Israel, which dictates to the banks certain conditions such as financing rates, mortgage interest, and the mortgage repayment ratio.

By and large, there are fixed guidelines such as the percentage of equity that must be provided and the amount of the repayment in relation to the amount of income, but the bank examines many other things such as the financial conduct of the customer and other obligations he has.

Foreign citizens can receive 50% financing for the purchase of a property in Israel, but it depends on each person; their financial capabilities and the level of risk according to the bank.

Yes, real estate licensing in Israel legally allows foreign citizens to purchase apartments in Israel, both new apartments from contractors and second-hand apartments from private sellers. But there are differences in the registration process itself and the purchase agreement with the seller.

The real difficulty for foreign citizens is usually related to transferring funds from abroad to Israel. Already at this stage it is important to note that a foreign citizen can open a bank account in Israel in his name. Usually the difficulty is in the transfer itself when the bank requires detailed explanations about the source of the money and the connection to the bank account from which the money was sent. The difficulty is much more dramatic when it comes to money from a limited liability company.

Often the simplest solution is to transfer the money directly to the seller’s bank account and then the seller is the one who will have to account for the amount of money coming in and usually it is enough for the bank to see the purchase contract to approve the entry of the amount.

The question of where it is best to invest in Israel is a very complex question because it very much depends on the desire of the seller. If the purpose of the investment is mainly yield and return on money, then outside the central cities is best because real estate prices are relatively low and the yield in terms of percentages is much higher. But on the other hand, if you are looking to invest in a place that is multi-purpose, which means an area that is suitable for both tourism and long-term residence, and in an area with very high and stable demand, then central cities like Tel Aviv and Jerusalem are the best investment. Personal considerations should also be included, for example, many investors have family in Israel, so sometimes it would be wise to purchase specifically in cities close to those families.

The best way is to first study the field in depth. If you are reading the content on my site now then you have most likely already started the process. Second, it is advisable to talk to professionals or relatives from the area to understand more about the state of the area in terms of prices, purchase options, required professionals such as a lawyer or mortgage consultant, tax consultant and more. After that, when the whole picture is complete for the buyer, it is necessary to decide where to purchase an apartment and what type of property.

You don’t really need a bank account, but it is indeed desirable to have an Israeli bank account because it makes the whole process much more convenient and simple. After all, a tenant who wants to pay rent every month will simply want to deposit funds in an Israeli account and not make a bank transfer. In addition, it is customary in Israel to give checks as rent payments, so in order to deposit them, an Israeli bank account is required.

As in most countries, in Israel most properties are represented by brokers and agents. In Israel it is customary for brokers to take a commission from both the seller and the buyer. The commission fee is approximately 2% of the total amount of the purchase as stated in the purchase agreement from each side. But it is important to clarify that everything can be negotiated andfor properties priced at a million dollars and north a 1% brokerage commission can be negotiated. According to the law there is no limit. A broker can demand as much brokerage commission as he wants and even charge some amount to the price of the property, but again, as stated, the customary commission is 2%.

In Israel, you are required to hire the services of a lawyer when you want to buy or sell property. The 2 main reasons are to perform due diligence on the property before making a final commitment to purchase it and to check that there are no warning notes on the property or that the property is mortgaged. Second, only a lawyer in Israel can register the apartment in the buyer’s name with the authorities. It is customary in Israel to pay a lawyer a fee ranging from 0.25%-1% of the total value of the deal. This does not mean that the one who charges more does a better job and vice versa, so it is important to rely on recommendations and experience.

There are many, many reasons, but the main reasons are the low supply compared to the high demand of the growing population through immigration. Other reasons include high construction costs attractive financing that can be obtained from the local banks, high demand in central areas, and investors from all over the world who continue to purchase properties in Israel

Contrary to popular world opinion, Israel is a stable and developed country with a strong economy that continues to grow. Real estate prices in Israel continue to rise and it doesn’t look like there will be a drop in prices in the coming years, so yes, investing in Israel and purchasing a property is considered a good investment with low risk.

Yes, foreign nationals can purchase property but the process is slightly different legally. But unequivocally yes and there are no limitations

Foreign citizens can receive financing of up to 50% of the value of the property as a mortgage with a spread of about 25 years

In general, almost everywhere in Israel the investment pays off when you look at the increase in value. Cities like Jerusalem and Tel Aviv have the highest demand but the lowest annual rental yield. When you look at central cities in the north and south, you can see that although they are less attractive, the annual yield and the increase in value there are percentages higher.

The brokerage fee used in Israel for the purchase of an apartment is 2% from the seller’s side and 2% from the buyer’s side. But this is a figure that is open to negotiation and can be lowered significantly

Lawyers in Israel charge for the due diligence of the property, the preparation of the legal agreement for purchase or sale, and the transfer of ownership between the buyer and the seller. The fee is derived from the value of the transaction and is usually between 0.25%-1%.

The most recommended way is to use the experience and ability of a recognized company that will accompany the buyer through the entire process of purchasing the property from end to end.

Dr. Ori Koskas is a business entrepreneur who founded multiple companies in the real estate, finance, and fintech sectors. He specializes in strategies for economic growth and financing solutions.

Companies as well as individuals interested in a growth strategy can contact Dr. Koskas for a personalized consulting session relating to business, real estate, and finance.

Have something you’d like to consult with Dr. Koskas about?

Leave your info and he will get back to you soon.

Dr. Ori Koskas is a business entrepreneur who founded multiple companies in the real estate, finance, and fintech sectors. He specializes in strategies for economic growth and financing solutions.

Companies as well as individuals interested in a growth strategy can contact Dr. Koskas for a personalized consulting session relating to business, real estate, and finance.

Have something you’d like to consult with Dr. Koskas about?

Leave your info and he will get back to you soon.

Most Viewed

New articles

Real estate agents in Israel are regulated by the Real Estate Agents Law, which was passed in 2008. This law establishes the rules and regulations

The future of real estate in Israel looks bright, with several key trends and predictions shaping the market. One of the most significant trends is

Haifa is a city located on the northern coast of Israel, with a population of over 280,000 people. The city is known for its vibrant

Investing in Israeli real estate can be a smart and rewarding decision because the country’s real estate market offers a number of attractive benefits and

Despite its small size, the State of Israel is one of the most talked about countries in the world media. It’s partly because of the

If you’ve been following me you know that I strongly believe in investing in Israeli real estate among other types of investments. Yet, I am

התחברות ללוח בקרה

1

המציאות עולה על כל דמיון.

האמרה המפורסמת הזאת מהדהדת לי בראש מהיום שאני זוכר את עצמי. תמיד הרגשתי שהדמיון שלי קצת יותר מפותח משל שאר האנשים בעולם. מאז שהייתי ילד קטן, הייתי מבלה שעות בלהסתכל על התקרה או מהחלון, מדמיין עולמות חדשים, עולמות של קסם וכוח, עולמות בהם אין גבול למה שיכול לקרות ושאפילו בסרטים המטורפים ביותר לא מצליחים להתקרב וליצור משהו דומה.

החלומות בלילה השפיעו עליי הכי הרבה. מעולם לא הצלחתי להבדיל בין המציאות לחלום בזמן שישנתי, ובכל פעם שהייתי מצליח לעוף בחלום או להזיז דברים בכוח המחשבה, הייתה לי תחושה של אושר, שסוף סוף יש משהו בעולם הזה שהוא מעבר לעולם שלנו.

זה לא הרגיש לי הגיוני שהמוח מסוגל לייצר את כל זה בעצמו.

בגלל החלומות האלה, תמיד האמנתי שיש איזה שהוא כוח עליון. אני לא איש דתי, זה בטוח, בעיקר בגלל שאני לא מסכים עם איך שהדת טוענת שעלינו להתייחס לאותו כוח עליון. כל מה שקשור לתפילות או לחוקים שעל פיהם, כביכול, עלינו לחיות, הפכו אותי לסקפטי וגרמו לי לחשוב שהדת היא יותר אידיאולוגיה מאשר אמונה, אבל בכל זאת תמיד חיפשתי סימנים.

חשבתי לעצמי שאם אותו כוח עליון אכן נתן לי את החלומות האלה, אז אולי באמת יש לי יעוד כלשהו בחיים, יעוד שהוא מעבר. אולי לחיים שלי אמורה להיות משמעות מיוחדת ושיש לי חלק כלשהו ביקום הזה. לפעמים אני מרגיש כאילו החיים שלי הם מבחן, וברגע שאעבור אותו, אני אבין באמת מה הייעוד שלי בעולם הזה.

אולי לכולם יש את המחשבות האלה, אבל כשהן בתוך הראש שלי, אני מרגיש שיש קשר בין הדמיון שלי לאותו כוח עליון. רמת המציאות של הדמיון שלי מרגישה כל כך מורכבת לפיענוח, עד שלפעמים אני לא מצליח להבין איפה החלום נגמר ואיפה המציאות מתחילה.

למרות שהמחשבות והרגשות האלה קיימים אצלי מהיום שאני זוכר את עצמי, שום דבר לא היה יכול להכין אותי לאירועים שעומדים לקרות.

פרק 1- החיים

ישבנו על הגג. היינו מוקפים בחושך מוחלט, אבל באופק יכולנו לראות כמה ניצוצות של אור, כמו כוכבים, רק על הקרקע. זאת הייתה לבנון. מחר בלילה אנחנו נחצה את הגבול כחלק ממבצע צבאי בשם “אדמה בוערת”.

במהלך החודשים האחרונים עלתה המתיחות בגבול ישראל – לבנון; טילים ורקטות החלו לעוף אל עבר כפרים וערים בצפון ישראל, הרעש החזק של הירי והסכנה המידית פגעו בשגרת החיים וגרמו לתושבים לפחד לצאת מהבתים שלהם. מטרת המבצע “אדמה בוערת” הייתה חיסול תאי הטרור הקטנים שהתמקמו צפונית לגבול, והחזרת השקט לצפון. אם הייתם שואלים את המפקד שלי, הוא היה אומר לכם שמטרת המבצע היא פשוטה: להרוג טרוריסטים, להציל ישראלים ולהשתדל להישאר בחיים בתהליך.

אלון ואני כבר לא היינו חיילים סדירים. בגיל 24, כבר הייתי משוחרר כשלוש שנים מהצבא, אבל כמובן שבזמנים מתוחים כאלה הלוחמים ביחידה שלי נקראים לשרת במילואים. כבר שבוע שאנחנו ממוקמים במוצב שצמוד לגבול בצד שלנו, ושומרים עליו מפני כל ניסיון חדירה או התקפה. עד כה היו לנו מספר היתקלויות עוינות עם טרוריסטים לבנונים שניסו להתגנב מעבר לגבול ולבצע פיגועים. למזלנו, הצלחנו למנוע את הניסיונות האלה די בקלות, כאשר חיל האוויר והשריון עשו את רוב העבודה עבורנו.

נשאר לנו עוד שבוע להישאר במוצב ולשמור על הגבול לפני שנוכל לחזור הביתה. בלילה הזה, ישבנו, אלון ואני, במשמרת על הגג של המפקדה במוצב, ששימש כבסיס התארגנות לפני יציאה לפעילות מעבר לגבול. מהגג יכולנו להשקיף על הגדר.

“אתה יודע מה ממש בא לי עכשיו?” אלון שאל.

“מה?”

“קערת מרק עוף גדולה שאימא שלי מכינה.”

צחקתי, “אתה כזה ילד של אימא. זה כל מה שאתה מסוגל לחשוב עליו עכשיו?”

“מה?” הוא חייך, “דניאל, על מה אתה כבר יכול לחשוב עכשיו?”

רציתי להגיד לו שעל הרבה דברים, אבל במקום זה פשוט אמרתי לו – “אני, האמת, חושב על הבחורה הזאת שהכרתי כשהיינו בחוף בשבוע שעבר. נראה לי שאני אזמין אותה לצאת כשנסיים פה”.

“או, אני בטוח שהיא מכינה אחלה מרק עוף!” אלון צחק.

“יאללה, רק מרק עוף יש לך בראש.”

“על מה עוד אני יכול לחשוב שאנחנו יושבים כאן, קר לנו ואנחנו אוכלים רק אוכל של צבא? אפילו הכלב שלי אוכל יותר ממה שאנחנו מקבלים פה.”

“כן אלון, אבל זאת לא דוגמה טובה, כי הכלב שלך אוכל יותר מרוב האנשים במדינה…” צחקתי.

“האמת שאתה צודק, אבל זה רק בגלל שאני עובד כל הזמן והוא לבד, אז אני רוצה לפנק אותו איכשהו, ואוכל זאת הדרך הכי טובה.”

“אלון, אתה פשוט עובד קשה מדי,” אמרתי. “ידעת שהאריה ישן 20 שעות ביום והוא עדיין מלך הג’ונגל? אם עבודה קשה הייתה המפתח להצלחה, אז החמור היה המלך.”

שנינו צחקנו ואז הייתה דממה.

” ממש הייתי רוצה שנסיים עם המילואים האלה כבר,” אלון אמר והסתכל אל הגבול.

כבר לא היינו אותם חבר’ה צעירים, בני 18, שהתגייסו עם מוטיבציה לשרת. בתקופה ההיא לא ממש הבנו את הסכנות שבמלחמה ומה אנחנו יכולים לאבד. להיפך, היינו מתרגשים ממבצעים כאלה, חיכינו להם, התלהבנו. היינו נחושים מאד להצליח לחסל טרוריסטים, היה בנו מעט מאד פחד ואפילו היינו רבים בינינו מי יפרוץ ראשון וייכנס בדלת אל תוך הלחימה הפוטנציאלית. באותן שלוש שנים היינו עושים כל מה שאמרו לנו, בלי לשאול שאלות ובלי שום היסוס או מחשבות על הסכנות ועל ההשלכות.

היום זה כבר שונה. בשלוש השנים מאז שהשתחררנו טיילנו בעולם, עבדנו, התאהבנו, נשבר לנו הלב והכי חשוב – למדנו שאנחנו לא באמת חסינים כמו שחשבנו.

חייכתי אל אלון, “זאת בסך-הכל עוד הרפתקה אחת שבסוף תוכל להוסיף לביוגרפיה שלך. זה יגמר מהר מאד.”

“דניאל, אני תמיד תוהה איך אתה מצליח לשמור על אופטימיות כל הזמן. אני מבקש ממך לא לעשות שום דבר טיפשי מחר, אני ממש רוצה לחזור הביתה, לחברה שלי, בחתיכה אחת.” אלון אמר ויכולתי לראות פחד בעיניו.

“אתה יודע שאני עושה דברים טיפשים רק שאני לבד,” עניתי, “ואגב, גם אני מחכה בקוצר רוח לחזור אל חברה שלך!” דברי עוררו את תשומת ליבו של אלון.

“אתה מבין, זאת הבעיה אתך, אני סומך עליך עם החיים שלי, אבל בשום אופן לא הייתי סומך עליך עם החברה שלי! לא הייתי משאיר אותך אתה לבד לרגע, שלא תגנוב לי אותה פתאום.”

“אל תדאג אחי,” הנחתי את ידי על כתפו, “אני מבטיח לך שתחזור אליה מהר יותר ממה שאתה חושב, אבל אני לא מבטיח לך שלא אגנוב אותה.”

הרוח הקרה של הלילה החלה לחדור אליי. הנחתי את כפות הידיים על הלחיים שלי על מנת לנסות לחמם את הפנים.

“איך הולך שם למעלה?” שמענו קול קורא לעברנו. הסתכלנו למטה וראינו את מתן ודיויד נועצים בנו מבטים. “מה, אתם בדייט? רוצים שנארגן לכם חדר?” הם צעקו אלינו בציניות.

המשמרת שלנו עמדה להסתיים. היה זה תורם של מתן ודיויד להחליף אותנו ולשמור, ואנחנו סוף סוף יכולנו לקבל כמה שעות של מנוחה לפני שהיום מתחיל.

“נשמח לחדר,” עניתי להם, “אם אפשר גם חדר עם נוף, ואם אתם כבר רושמים הזמנה -תוסיפו מרק עוף לאלון.”

ירדנו מהגג והתקדמנו לכיוון האוהל שלנו. נכנסו אל שקי שינה במטרה להירדם, אבל הקור הקשה עלינו. היינו צריכים לישון קרוב אחד לשני. כשאתה בצבא, במצבים כמו שאנחנו היינו בהם, לישון צמוד לגבר אחר זה לא כזה מפריע לך ברמה האינטימית. חום הגוף של אדם אחר זאת הדרך הכי טובה להתחמם, אז עושים מה שצריך.

מה שכן הפריע לי זה הנחירות שלו. למרות האוכל המגעיל, הקור הנוראי ותנאי השינה הקשים, דווקא די שמחתי לחזור שוב לצוות שלי. משהו בלהיות עם החברים לצוות, גרם לי להרגיש חי יותר. אין שום דרך בעולם שמגבשת אנשים יותר מאשר לשרת ביחד בצבא. המצב הזה, שאתה נלחם לצד אדם אחר ושניכם נמצאים תחת אותה סכנה, מחבר ביניכם ברמה שהיא מעבר לרמה החברית. באותם רגעים אתם הופכים להיות אחים.

בדיוק לפני שעמדתי להירדם, שמעתי צעדים מתקרבים אל עבר פתח האוהל שלנו.

“דניאל?” שמעתי לחישה. זה היה ליאור סיני, המפקד של הצוות שלי. “דניאל, אתה יכול לצאת רגע?”

יצאתי משק השינה שלי, נזהרתי לא להעיר את אלון או את שאר חברי הצוות, ויצאתי החוצה לראות מה ליאור רוצה. ליאור היה המפקד שכולם העריצו, הוא אולי לא היה הבחור הכי חכם או מוכשר בצוות, אבל הוא ללא ספק היה כריזמטי וידע להנהיג. הוא ידע לקבל החלטות, להקשיב לאחרים ולשים את ביטחון הצוות במקום הראשון, תמיד.

“היי, סליחה שאני מפריע לך, אני יודע שבדיוק סיימת את המשמרת שלך,” ליאור אמר, “רציתי לקבל את חוות הדעת שלך לגבי איזה ציוד פריצה אנחנו צריכים לקחת מחר לפעילות, המערכת ההידראולית או חומרי נפץ? אני פשוט רוצה לוודא שהיה לנו כל מה שאנחנו צריכים שם ולא נתקע”.

“אנחנו נצטרך לפרוץ בצורה מהירה ומלוכלכת,” עניתי לליאור בלי היסוס. “אם נשתמש במערכת ההידראולית לפריצה קרה, זה ייקח יותר מדי זמן. אנחנו חייבים לבחור באופציה המהירה יותר, אז ללא ספק חומרי נפץ”.

“כן, אתה צודק,” הוא אמר, “באמת מזל שיש לי אותך בצוות. כל מפקד צריך שיהיה לו איזה דניאל כמוך.” ליאור נתן טפיחה על השכם והמשיך בדרכו אל האוהל שלו.

היום שלמחרת היה מוקדש כולו להכנת כל מה שאנחנו צריכים לפעילות מעבר לגבול. ארזנו את התיקים, בדקנו שהציוד שלנו עובד, עברנו תדריכים על המבצע ותרגלנו מקרים ותגובות לאירועים שיכולים לקרות לנו שם.

עם רדת החשכה, היינו צריכים לצאת למסע של 8 קילומטרים מעבר לגבול, אל מבנה שהמודיעין שלנו חשד שמכיל אמצעי לחימה. המטרה שלנו הייתה פשוטה – לאתר את המחסן, להשמיד אותו ואת מה שבתוכו ולחזור לישראל כמה שיותר מהר.

בארוחת הערב שקדמה לפעילות, כל הצוות היה די שקט. ישבנו, כל 18 חברי הצוות, ופשוט הסתכלנו איך השמש שוקעת. כשהגיע הזמן, עלינו על ציוד והתחלנו תנועה אל היעד.

אתם תופתעו לגלות באיזו קלות אפשר היה לעבור את הגבול, בלי לעורר תשומת לב מיותרת. אפשר להאמין שדווקא קבוצה כמונו, תהפוך מידית למטרה גלויה, אבל בחושך העבה והשיחים הגבוהים שהקיפו אותנו, יכולנו לנוע די בקלות, בלי שישימו לב אלינו.

אחרי כ-3 שעות הליכה בהתגנבות שקטה, הצלחנו להגיע אל המחסן. המבנה היה נראה שבור, אפור ומלא אבק. כתמים וחלודה קישטו את הקירות שהקיפו את המבנה, והיה נראה כאילו הוא עומד לקרוס בכל רגע. המחשבה הראשונה שלי הייתה שצריך להיות אידיוט מוחלט בשביל לאכסן פה נשקים ואמצעי לחימה אחרים, ואם באמת היו בפנים אמצעים שכאלה, למה המקום כזה מבודד ובלי שמירה בכלל?

“דניאל, אלון, מתן.” ליאור לחש וסימן לנו להגיע אליו. ארבעתנו התקבצנו, מנותקים מהצוות.

“משהו כאן מרגיש לי מאד מוזר,” ליאור אמר בקול הססני. אלון, מתן ואני הנהנו בראשינו והראנו לו שאנחנו אכן מסכימים עם התחושה שלו. “ארבעתנו בלבד נתקדם אל המבנה ונסרוק אותו לפני הצוות, ליתר ביטחון.”

אלון הסתכל אליי וחייך, “דניאל, איך אני תמיד עושה את אותה טעות וממשיך להיות בן הזוג שלך?”

“אתה הקמע שלי,” צחקתי אליו בחזרה, קרצתי לו וסימנתי לו להתקדם אחרי.

שמרנו על גובה נמוך והתחלנו להתקדם, ארבעתנו, אל המבנה. שאר הצוות המתין בסבלנות, בכריעה, בשיחים שהיו מאחורינו. הם חיכו לסימן מאתנו אם להתקדם אלינו. היינו במרחק של 10 מטר מהמבנה, כשלפתע שמענו פיצוץ חזק מאחורינו. מיד לאחר הפיצוץ התחלנו לשמוע ירי. הירי התגבר, באנג, באנג, באנג.

“הירי נורה לכיוון הצוות!” אלון צעק.

ליאור תפס מהר את מכשיר הקשר שלו והחל לדווח על המתקפה. הוא גם ניסה, כמובן, לקבל דיווח מהצוות. “הלו? יורים עלינו! תתפסו מחסה! כולם בסדר?” ליאור נתן לי מבט חטוף וצעק, “מתן, בוא אחרי אל המחסן, נסרוק אותו בזריזות. דניאל ואלון, אתם תמצאו מחסה ואל תזוזו! הצוות יסתדר.”

הסתכלתי על ליאור ומתן כאשר הם החלו להתרחק מאתנו והתקדמו אל תוך המחסן. לאחר מכן הבטתי אל אלון.

“דניאל, אתה הבטחת לי!” אלון צעק. אחרי כמעט 20 שנה של חברות, אלון יכול היה לקרוא אותי יותר טוב מכולם. “אתה הבטחת שלא תעשה משהו טיפשי!”

“אמרתי לך בפירוש שאני אעשה רק אם אני אהיה לבד, ובאמת התכוונתי לזה!” צעקתי תחת רעש הירי החזק, “תישאר פה, אני ארוץ מהר לבדוק שהצוות בסדר.”

אלון התחיל לצעוק לעברי, אבל אני כבר לא הקשבתי בשלב הזה. פשוט יצאתי בריצה בחזרה אל השיחים, במקום בו עזבנו את הצוות, תוך כדי שאני שומע את הירי הרועש ממשיך. הבטתי לאחור וראיתי את אלון כמה מטרים בודדים מאחוריי.

“באמת חשבת שאני אמתין בסבלנות ואתן לך לחזור לבד?” הוא אמר תוך כדי שהוא מצמצם את הפער בנינו, “תגביר את הקצב, אתה רץ לאט מדי!”

הגענו במהירות אל השיחים ותפסנו מחסה מאחורי סככה קטנה שהייתה שם. העברנו את הנצרה של הרובים למצב ירי בודד והתחלנו לירות אל עבר האזור שממנו הגיע הירי. כעבור מספר רגעים הגיע מסוק הגיבוי שליאור הזמין בקשר.

“וואו, זה היה מהיר!” אמרתי לאלון בזמן שאני מחליף מחסנית לנשק, “זהו, הכול יהיה בסדר, אנחנו כבר בחצי הדרך הביתה!”

בקושי הספקתי לסיים את המשפט כאשר טיל בזוקה פגע בסככה ששימשה עבורנו כמחסה. הכול קרה כל-כך מהר, שלא היה לי זמן להגיב. הסככה החלה לקרוס ולהישבר למלא חתיכות שהחלו ליפול עלינו. אחת החתיכות נפלה על ראשי והפילה אותי על הקרקע. לפתע החשכה השתלטה עליי ולא ראיתי כלום. יכולתי לשמוע את אלון צועק, אבל זה נשמע כאילו הוא נמצא במרחק רב ממני.

“דניאל, אתה חייב לקום! הבטחת!”

היה חושך מוחלט. ניסיתי לפקוח את עיניי, אבל לא היה כל הבדל בין אם עיניי היו פקוחות או סגורות. אם הן היו פתוחות או סגורות, בכלל לא הייתי בטוח.

לפתע הרגשתי גל של חום עוטף אותי. האדמה הרגישה רכה, נעימה וחולית, והתחלתי להרגיש מן עקצוץ בגבי. יכולתי לשמוע מן זמזום שמקיף אותי, בא והולך. החשכה נראתה כאילו היא מתחילה להתבהר והרגשתי שאני יכול לנסות שוב לפקוח את עיניי.

הייתי ערום. מולי, יכולתי לראות ים אינסופי, עם מים כל-כך כחולים, שהיה אפשר לחשוב שצוירו באמצעות מכחול. החול הלבן היה נעים, כאילו היה בתולי, ללא מגע ידי אדם. היה זה אחד מאותם מצבים שלא באמת יכולתי לדעת אם אני חולם, או שאני באמת נמצא שם. המוח שלי אמר לי שזה אמיתי ונטיתי להאמין לו.

מצד שני, התחלתי לחשוד שאולי אני מת. בכל מקרה הרגשתי שאני מוכן. מעולם לא הרגשתי כל-כך רגוע, וגם לא ממש היה אכפת לי אם אני חי או מת. זה לא שינה לי באותו רגע. חשתי את השמש מחממת את גופי ובריזה קרה ונעימה עם רסיסים של טיפות מים מהגלים המתנפצים יצרה איזון מושלם. התיישבתי.

מיד לאחר מכן צל גדול היה עליי, השמש הוסתרה. ברגע הראשון הייתי בטוח שמדובר בענן, אבל לא היה אפילו ענן אחד בשמיים. הרמתי את מבטי וראיתי אדם מעליי.

הוא לבש רק מגבת סביב מותניו, ממש כמו טיטול. גופו היה רחב וחטוב, כאילו היה מפוסל משיש. שיערו השחור התנופף ברוח, כאילו הוא מאבק את כתפיו.

הרגשתי את מבטו נעוץ בי וניסיתי להבין על פי הבעות הפנים שלו מה כוונותיו, אך זקנו השחור והעבה הסתיר את פניו ולא איפשר לי לראות מי הוא.

“מי אתה?” שאלתי באומץ. תהיתי לעצמי איך האדם הזה הגיע לכאן, לחוף שלי.

“דניאל, אתה תגלה את התשובה לשאלה הזאת בהמשך, אבל בינתיים אנחנו צריכים לנסות להחזיר אותך בחזרה. כרגע, אתה תקוע.” קולו היה עמוק אך עדין, כמו אב המדבר אל ילדו.

“רגע, מה אם אני לא רוצה לחזור בחזרה? מה אם אני רוצה להישאר פה?” הגבתי לו בלי באמת להבין או לחשוב מה זה אומר בכלל.

עיניו של האיש הסתכלו עמוק אל תוכי, והרגשתי שהוא רואה אותי בצורה אחרת מרוב האנשים. הרגשתי שמה שהוא מסתכל עליו הוא לא רק הגוף העירום שלי יושב על החוף.

” מדהים פה, אה?” הוא שאל, “להיות תקוע בין שני עולמות שונים? דניאל, נשארו לך עוד הרבה שנים בעולם החיים.”

לפני שיכולתי לשאול אותו עוד משהו, התחלתי להרגיש כאילו אני נמצא בנפילה חופשית, אבל בהילוך איטי. כבר לא הייתי בחוף המדהים והאיש הזר נעלם. מצאתי את עצמי שוב בחשכה, נופל, עד שלפתע נעצרתי.

עכשיו הרגשתי שקט. לא יכולתי לשמוע כלום, לראות כלום, להרגיש כלום. לאן חזרתי?

אז הבנתי שעיניי סגורות והתחלתי לפקוח אותן לאט-לאט.

אלון היה ממש לידי, ישן על כיסא. הכול היה בהיר מאד, יכולתי להריח את חומרי הסטריליות שבחדר. הידיים שלי הרגישו כבדות בעודי מנסה להרים אותן אל פניי. הראש שלי היה חבוש והרגשתי שהתחבושת הייתה חמה ואפילו לחה קצת. התנועות הקצרות שלי הספיקו בשביל להעיר את אלון, שהחל להזדקף והעלה חיוך של הקלה על פניו.

“איך אתה מרגיש?” הוא שאל.

“אני חושב שאני בסדר,” עניתי תוך כדי שאני שם לב לצינורית האינפוזיה שמחוברת לזרוע שלי, “מה קרה?”

“קיבלת מכה מאד חזקה בראש ואיבדת את ההכרה. המסוק שליאור הזמין הביא אותך לכאן, ואתה פה כבר מספר ימים. כשהרופאים ניתחו אותך אתה מתת להם על שולחן הניתוחים, מוות קליני. אחרי 90 שניות בערך הם הצליחו לגרום ללב שלך לחזור לפעום. הם גם אמרו שאי אפשר לדעת אם יש איזשהו נזק בלתי הפיך והדרך היחידה שלהם לגלות תהיה כשתתעורר.”

הקשבתי לכל מה שאלון סיפר לי ולא יכולתי שלא לחשוב על האיש שפגשתי באותו חוף. זה היה החלום הכי מציאותי שחוויתי בחיי. עם כל מה שאלון סיפר, התחלתי לחשוב שאולי זה היה חלום.

“בוקר טוב ליפהפייה הנרדמת!” מישהו אמר בעודו נכנס אל החדר. הסתכלתי וראיתי את הרופא נכנס אל החדר ומתקדם לעברי. “אני רואה שסוף-סוף התעוררת, דניאל. הבהלת אותנו לא מעט בימים האחרונים. עכשיו בוא נבדוק איך אתה מרגיש. בבקשה תעקוב אחרי העט שלי עם העיניים שלך.”

הדוקטור הזיז את העט שלו מצד לצד, קרוב לפניי, ואז הרחיק אותו. “מעולה!” הוא אמר, “עכשיו בבקשה תזיז את הבהונות שלך.”

אחרי מספר בדיקות נוספות הרופא הגיע למסקנה שאין לי נזק בלתי הפיך כתוצאה מהפציעה ומהמוות הקליני שחוויתי. “אתה בן-אדם בר מזל, דניאל. אתה כנראה תחזור לתפוקה מלאה תוך זמן קצר, ימים בודדים, אני מעריך.” אמר הרופא בעודו רושם הערות בפנקסו. אלון אמר לו תודה ולחץ את ידו, והוא יצא מהחדר.

“אגב, נזכרתי, דניאל, שיש לך המון מזל שאתה נמצא פה עכשיו בבית החולים, כי אני בטוח שליאור ממש רוצה להרוג אותך עכשיו”, אלון אמר, “הוא היה פה אתמול, הוא ממש מודאג, אני אעדכן אותו רשמית שאתה בסדר”.

“מה קרה בסוף בפעילות?” שאלתי, ונזכרתי שלפני שאיבדתי את ההכרה, ליאור והצוות היו תחת מתקפת ירי ממש מחוץ למחסן.

“כולם בסדר גמור,” אלון ענה, “היו כמה מחבלים בודדים שירו עלינו, אבל חיסלנו אותם מהר מאד ואף אחד אחר מהצוות לא נפצע. סרקנו את המחסן מהר וגילינו שבסוף הוא היה בכלל ריק לחלוטין.”

הוקל לי לשמוע ששאר הצוות יצא ללא פגע מהפעילות, אבל התאכזבתי שפספסתי את כל מה שקרה בהמשך. החלטתי פשוט לשנות נושא.

“תשמע אלון, היה לי חלום מטורף,” התחלתי לספר לו את כל מה שחלמתי.

“דניאל, יש לך חלומות הזויים,” הוא אמר והנהן בראשו, “אולי הגיע הזמן שאלך ואתן לך לנוח קצת. אני מקווה באמת שתצא מפה בהקדם האפשרי.”

כשחושבים על זה, החלום לא היה כזה הזוי. להיות בחוף אקזוטי מדהים, לשכב על החול כאשר קרני השמש מאירות עליי ומחממות אותי… בהשוואה לחלומות שלי בדרך כלל, זה היה חלום נורמלי יחסית. משהו בו פשוט הרגיש לי מאד שונה. אולי זה היה בגלל משככי הכאבים שנתנו לי, אני מאד רגיש לתרופות כאלה.

“תודה שבאת, אלון, ושנשארת לוודא שאני בסדר,” אמרתי, “אבל אתה רואה? אמרתי לך שהכול יהיה בסדר בסוף, לא?”

“כן ממש הכול בסדר,” אלון צחק, “רק שבגרסה שלי ל’הכל בסדר’ אתה לא אמור להיות מחוסר הכרה בבית חולים למשך יומיים. בכל מקרה אני זז הביתה להתקלח ולנוח גם כן, אני אבוא לבקר אותך שוב מחר.”

הסתובבתי במיטה וניסיתי למצוא תנוחה טובה יותר במיטה הנוראית של בית החולים. במהרה הצלחתי להירדם, נכנעתי לגוף שלי שהיה תשוש מאד מהפציעה ולא נלחמתי בעייפות שהרגשתי.